Examine This Report about Opening Offshore Bank Account

Table of ContentsNot known Facts About Opening Offshore Bank AccountSee This Report on Opening Offshore Bank AccountThe Basic Principles Of Opening Offshore Bank Account Everything about Opening Offshore Bank Account

If you are planning to move to the country, you opened a bank account, or you simply desire to visit the nation, then set up the account is simply enough. However, if you desire to protect your riches because country, multiply it, or capitalize on tax obligation benefits, then you have a whole lot even more to do.

This is excellent due to the fact that you are decreasing the danger of losing everything in case one of the financial investments falls. If you keep in mind the financial recession in the year 2007-2008, many people in the USA shed almost everything. When you hold a few of your possessions under overseas financial, then you are reducing the risk of shedding everything when a crisis strikes your country.

Banking at house exposes your wealth to inconsiderate bureaucrats who can determine to freeze your financial resources also if they do not have proof for criminal charges. This is why you require overseas banking.

Keep your wide range out of reach through overseas banking. Different financial institutions include various plans, which suggests you can improve services, including rates of interest for deposits. As well as while a lot of banks and also financial establishments in the United States offer almost the exact same rate, try to find better prices outside the country.

The Only Guide to Opening Offshore Bank Account

Reach recognize the conditions of your overseas financial institution to guarantee you take pleasure in optimum benefits. Some financial institutions might need you not to take out any amount from your account within a year so as to earn the full amount of rate of interest. Get informed, after that determine. While a lot of countries in the western globe are associated with undesirable money battles, opening up an overseas checking account can help you dodge the consequences.

This is something you do not expect to get from overseas financial institutions they do not take such dangers. Overseas banking boosts your confidence, understanding that your cost savings are safe and also secure. Every person wants to decrease their tax obligation problem as a lot as possible, and this might be one of the reasons why well-off people consider overseas financial useful reference institution accounts.

Things about Opening Offshore Bank Account

Nearly every little thing that has advantages has a redirected here number of disadvantages also. Right here are the main negative aspects of offshore banking. Offshore savings account are not always monetarily safe. And this relies on the policies of the offshore bank you choose to bank with. For circumstances, throughout the wonderful economic downturn, some financiers lost their cash because their funds were not insured in the country; they deposited their money.

This means that there are risks entailed, too. Transferring with an overseas bank makes you a subject of investigation. The factor for this is the reality that an offshore financial account is typically connected with criminal activities. These consist of money laundering, tax evasion, as well as financing of terrorist teams or criminal gangs, to name a few.

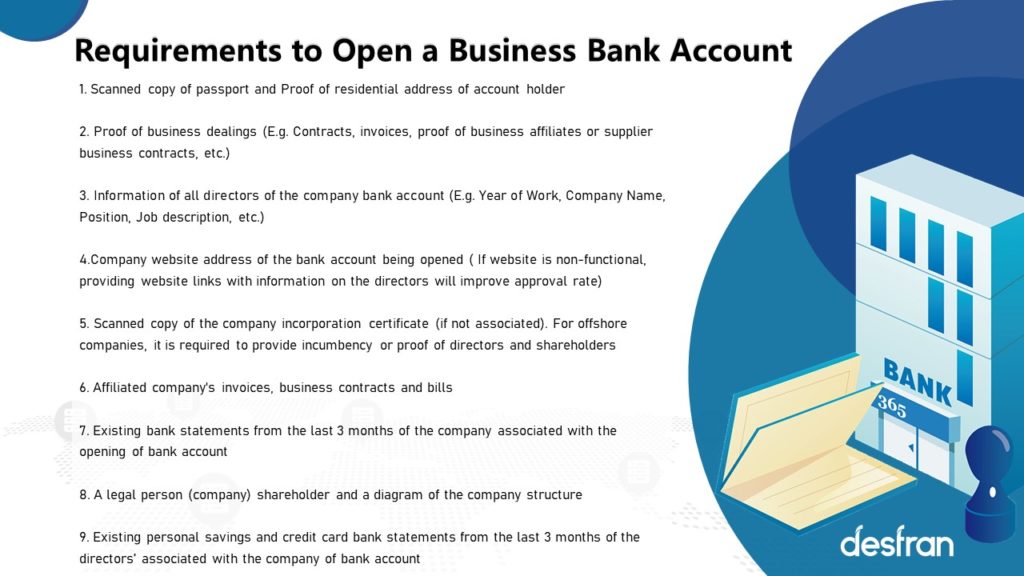

These accounts are perfectly legal for any individual as long why not check here as you satisfy the demands. Some fees for keeping the overseas savings account can be too expensive, particularly if you are not receiving efficient financial investment services. opening offshore bank account. You need to comprehend all the charges associated with your account, including charges for failure to maintain a minimal balance.

It is constantly hard to be there in-person to solve a problem or obtain most info regarding your offshore checking account. And when the need emerges, it is rather expensive. Opening up an overseas account is easy, but you could decide to employ somebody to take you through the procedure. The question is, should you hire somebody or do it on your own? Find out more listed below.

A Biased View of Opening Offshore Bank Account

OSPs have experience handling offshore financial, which means they have already develop a positive connection with many of the financial institutions (opening offshore bank account). The whole process will be very easy and also rapid with such links as well as understanding of the demands. An OSP handles a minimal variety of banks state 10 to 20 offshore banks, and maybe you do not rely on any one of them.

Whether you pick to deal with an OSP or manage the procedure by on your own, make sure you are making an educated decision. Either method can be untidy if you miss something crucial. That claimed, see to it that your selected OSP provides you with a list of all financial institutions they collaborate with, including the services they offer.